Chase CD rates can be a significant component of your financial strategy, especially when it comes to growing your savings safely and reliably. As interest rates fluctuate, many individuals are searching for the best ways to maximize their earnings without taking on unnecessary risks. Certificate of Deposit (CD) accounts offer a perfect solution, allowing savers to lock in a fixed interest rate for a specified term, ensuring a guaranteed return on their investment. With Chase Bank, one of the leading financial institutions in the United States, you can take advantage of competitive CD rates that cater to various savings goals and timeframes.

Understanding how Chase CD rates work is crucial to making informed decisions about your savings strategy. These rates are influenced by several factors, including the term length, the amount deposited, and the current economic climate. As you consider your options, it's essential to weigh the benefits of a CD against other savings accounts and investment vehicles to determine the best fit for your financial needs.

In this article, we will explore the intricacies of Chase CD rates, addressing common questions, comparing terms, and outlining how you can make the most of your savings. Whether you are a seasoned investor or just starting your savings journey, knowing the ins and outs of Chase's offerings can help you achieve your financial goals.

What Are Chase CD Rates?

Chase CD rates refer to the interest rates offered by Chase Bank on their Certificate of Deposit accounts. These rates are typically higher than traditional savings accounts, making them an attractive option for individuals looking to grow their savings securely. When you open a CD, you agree to deposit a specific amount of money for a predetermined term, during which you cannot access your funds without incurring penalties. The interest earned on the CD is compounded and paid out at the end of the term, providing a guaranteed return on your investment.

How Do Chase CD Rates Compare to Other Banks?

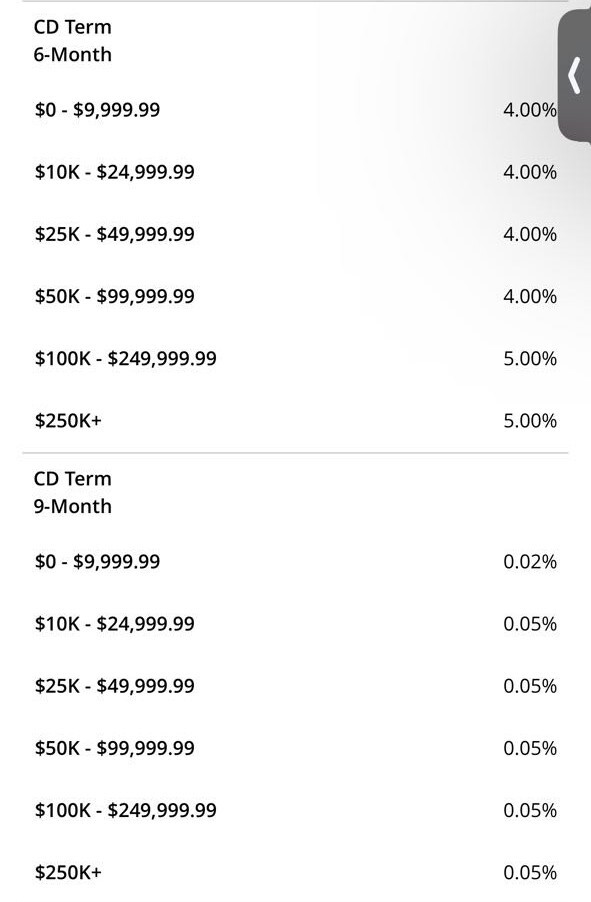

When evaluating Chase CD rates, it's essential to compare them with rates offered by other financial institutions. While Chase is known for its competitive rates, factors such as minimum deposit requirements, terms, and penalties for early withdrawal should also be considered. Here's a quick comparison:

- Minimum Deposits: Chase often requires a minimum deposit of $1,000, which is standard among many banks.

- Term Lengths: Chase offers a variety of term lengths, ranging from 1 month to 10 years, allowing for flexibility in savings strategy.

- Interest Rates: While Chase's rates are competitive, some online banks may offer higher rates due to lower overhead costs.

What Are the Benefits of Choosing Chase CD Rates?

Opting for Chase CD rates comes with several advantages that can enhance your saving experience:

- Guaranteed Returns: Unlike stock investments, CDs offer a fixed interest rate, ensuring you know exactly how much you'll earn.

- FDIC Insurance: Your deposits are insured up to $250,000, providing peace of mind in case of bank failure.

- Flexible Terms: With various term lengths, you can choose a CD that aligns with your financial goals.

How Do I Open a Chase CD Account?

Opening a Chase CD account is a straightforward process. Here are the steps you can follow:

- Visit the Chase website or a local branch.

- Select the type of CD you wish to open and review the terms and rates.

- Complete the application process by providing personal information and making your initial deposit.

- Review and sign the account agreement.

Can I Access My Funds Before the CD Matures?

Accessing your funds before the maturity date of a CD typically results in an early withdrawal penalty, which can vary based on the length of the term and the bank's policies. It's crucial to understand these penalties before committing to a CD to avoid unexpected losses. Chase typically imposes a penalty of 90 days' interest for terms of less than one year and 180 days' interest for terms longer than one year.

What Happens When My CD Matures?

Upon maturity, you have several options regarding your CD:

- Withdraw Your Funds: You can withdraw the principal amount along with the accrued interest.

- Renew the CD: Many banks, including Chase, offer the option to roll over the funds into a new CD with the current rates.

- Transfer the Funds: You may also transfer your funds to another account or investment vehicle as you see fit.

How to Make the Most of Chase CD Rates?

To maximize the benefits of Chase CD rates, consider the following strategies:

- Shop Around: Compare rates and terms from various banks to ensure you're getting the best deal.

- Invest for the Long Term: Longer-term CDs typically offer higher interest rates, so consider your financial goals.

- Consider Laddering: Create a CD ladder by opening multiple CDs with varying terms to access funds periodically while still earning higher rates.

Conclusion: Are Chase CD Rates Right for You?

Chase CD rates can be an excellent addition to your overall savings strategy, providing guaranteed returns and security for your deposits. By understanding the terms, benefits, and potential drawbacks, you can decide whether a CD with Chase Bank aligns with your financial goals. Take the time to compare rates, explore your options, and consider how CDs can help you achieve your short-term and long-term savings objectives.

You Might Also Like

Unveiling The Life Of Tan Chuan-Jin's Wife: A Journey Of Love And SupportUnleashing The Excitement Of Fun Football Unblocked

Discovering The Life And Legacy Of Hattel Alan

Bubba The Love Sponge's Wife: A Deep Dive Into Their Relationship

Exciting News: Harry And Meghan Expect Twins!

Article Recommendations

- Natasia Demetriou Husband

- Liam Payne Lpsg

- Billy Wirth

- Did Tom Selleck Die Today

- Drew Bledsoe Net Worth

- Gloria Borger Health

- Custom Udon Artist

- Deng Lun Wife

- Randy Moss Wife

- Dondon Nakar Wife